Dear friends,

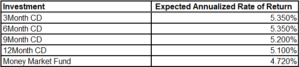

Many of you have called about investment into a Certificate of Deposit (CD) and Money Market Fund. A certificate of deposit (CD) is a savings product that earns interest on a lump sum of money for a fixed amount of time. CDs differ from savings accounts in that the investor doesn’t have access to the funds during the CD term. Due to this lack of access, CDs generally pay higher interest rates than savings accounts as an incentive for lost liquidity. A benefit to a CD is that it allows investors to lock in a rate for a specified length of time. For those investors seeking more liquidity, a money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash, cash equivalent securities, and high-credit-rating, debt-based securities with a short-term maturity (such as U.S. Treasuries). Due to the liquid nature of these investments, the interest rate can fluctuate. Since the Fed increased rates last year, these investments now offer very competitive returns. We have included a table below to help compare the current offerings. If you are interested in learning more about these investment options, please do not hesitate to reach out.

Note: Please be advised the expected annualized return for CDs are general figures to represent the relative rates available on the market and the money market fund return figure is using JPMorgan Liquid Assets Money Market Fund (PJLXX) as an example. All data are as of December 7th, 2023.

www.lpl.com

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set forth may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Investing in stock includes numerous specific risks, including the fluctuation of dividends, loss of principal, and potential illiquidity of the investment in a falling market.

Investing in foreign and emerging market securities involves special additional risks. These risks include but are not limited to currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Investment advice offered through Private Advisor Group, a registered investment advisor and separate entity from The Legacy Foundation.

Certificates of Deposit are FDIC-insured and offer a fixed rate of return if held to maturity. Brokered CDs sold prior to maturity in the secondary market may result in loss of principal due to fluctuations in the interest rate or lack of liquidity. Brokered CDs are registered with the Depository Trust Corp. (“DTC”). Brokered CDs with step-down and/or call provisions may be less favorable than traditional CDs without these features.

An investment in the Fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the Fund seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Fund.

Recent Comments