Of central focus to investors has been the possibility of the Federal Reserve (Fed) altering monetary policy in the near future to adjust for improving economic conditions. Specifically, speculation is that new Fed policy will allow interest rates to rise to normal levels and will involve a reduction in its current quantitative easing (QE) program. There are two aspects of the program that have kept interest rates low, each addressing different areas of the interest rate curve and both designed to bolster the economic recovery following the recession caused by the financial crisis of 2008. The two instruments employed by the Fed are manipulation of the federal funds rate and quantitative easing.

The federal funds rate, which is set by the Fed, is the overnight interest rate charged on loans made from one bank to another to meet the reserve requirement. The reserve requirement, also set by the Fed, is the percentage of cash deposited by bank customers that the banks must hold at any given time to ensure a sufficient amount of cash is available to cover withdrawals. Currently the reserve rate is about 10%, which means that banks may loan the remaining 90% of deposited funds to other customers in the form of home loans or other bank loan products. The current federal funds rate is set to 0.0%-0.25%. Because the federal funds rate represents the interest on the banks’ line of credit, it directly affects the short-term interest rates that the bank charges to customers, the rate of interest on CDs and bonds, and the interest rate on home loans, among other things. The Fed has stated they will keep the federal funds rate at its current, near zero level until one of two things happen:

1) Inflation rises to an annualized rate of 2.5%

2) Unemployment falls to 6.5%

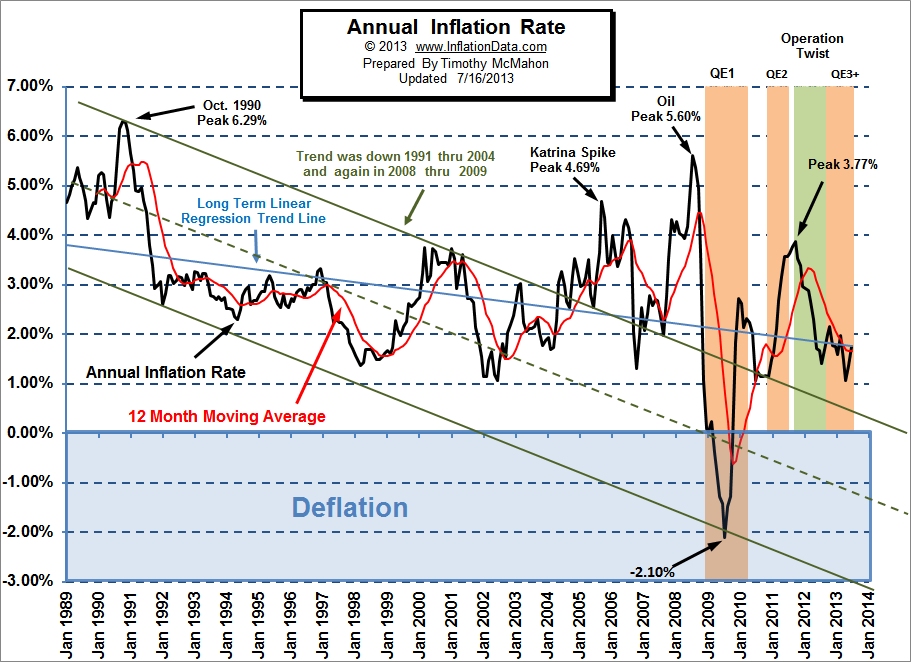

As of June 2013, the inflation rate stands at an annualized rate of 1.75%. The chart below shows a graph of the annualized inflation rates since 1989. While post-financial crisis inflation peaked at 3.77% at the end of QE2 in 2011, it has since declined below 2.00% and has stayed below that level since early 2012. The inflation rate is determined by the Consumer Price Index (CPI), which measures the change in the price level of a basket of consumer goods and services purchased by households. The July 2013 CPI number is scheduled to be released on August 15th.

The July 2013 unemployment rate currently stands at 7.4%. This is a decrease from June, down 0.2% from 7.6%. A graph of the unemployment rate can be seen below. Unemployment hit a low before the 2008 financial crisis at 4.4% in May 2007. The crisis resulted in a spike in this rate, pushing it up to its peak at 10.0% in October 2009. The rate has since steadily declined but still remains far above the 6.5% rate designated by the Fed as a trigger to raise short-term interest rates.

Source: Bureau of Labor Statistics

In addition to the federal funds rate, the Fed uses a tactic known as quantitative easing or QE. QE3 (the third round of QE) involves buying $45 billion in mortgage-backed securities (MBS) and $40 billion in long-term treasuries. This helps keep rates down in the bond markets while buoying equity prices, creating an attractive environment for individual and institutional investors. The current QE program has no set end date, but the Fed has indicated that it will begin to wind down these purchases (known as “tapering”) in the coming months, with the goal of ending the program sometime in 2014. This roadmap could be altered with changing economic conditions. If the economy improves faster than expected, the Fed may taper purchases at a higher rate, while declining economic conditions could lead the Fed to maintain QE at full capacity for the foreseeable future. The consensus of financial reporters and players on Wall Street holds that the Fed will begin to taper as soon as September 2013.

This tapering has unknown implications for financial markets, which have experienced a significant bull run for several years. In May and June of this year, Ben Bernanke, the Chairman of the Federal Reserve, first indicated the Fed was planning an exit strategy for QE. Not only were bond markets hit dramatically, but equity prices declined as well. While there is a possibility the looming tapering has already been priced into the markets as they currently stand, an unexpectedly-aggressive tapering announcement at the next Federal Open Market Committee meeting, scheduled for September 17th and 18th of this year, may trigger another selloff like that seen in the second quarter of this year. The wise investor would structure a portfolio robust to such events.

Recent Comments