Dear Friends,

Recent inflation data shows that the price levels are still decreasing but appear to be coming down slower than expected. Financial markets have so far shrugged off such a notion, even as rate-cut expectations have moderated. Optimism has been fueled by recent earnings, especially from a few prominent technology companies. Find out more about what is driving the markets in this week’s newsletter.

Economy, Geopolitics, and Commodities

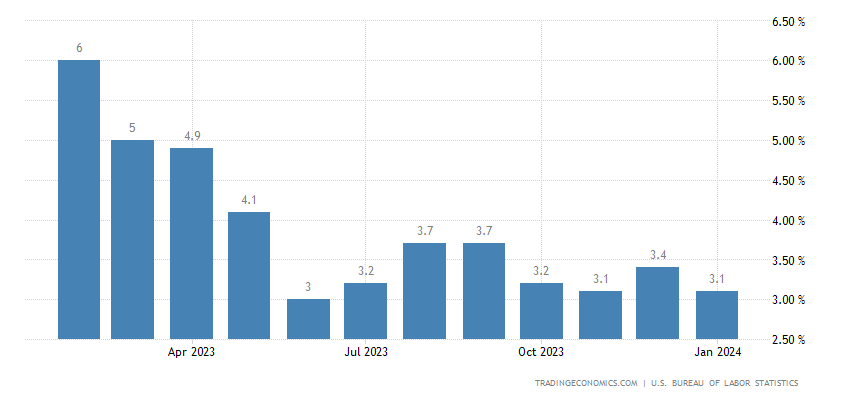

1. What the January Numbers Say About Inflation

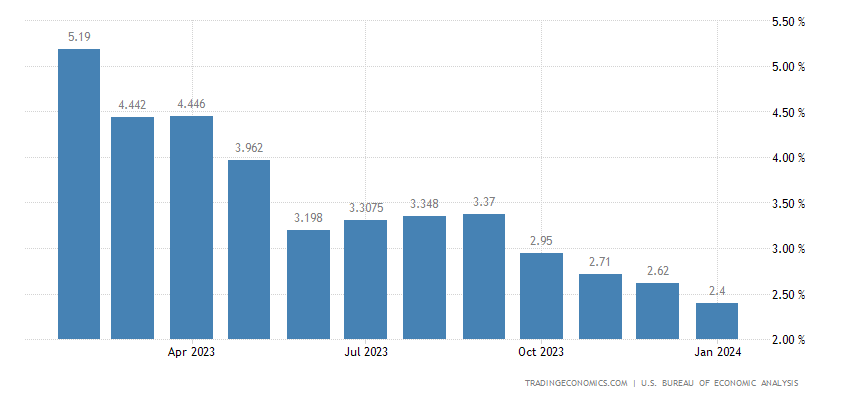

The Labor Department’s monthly report on consumer prices, known as the consumer-price index or CPI, is generally thought of as “the” inflation report. But the Labor Department’s figures aren’t the Fed’s focus. Instead, the central bank bases its 2% inflation target on the inflation data that comes out with the Commerce Department’s monthly report on income and spending. That is known as the personal-consumption expenditures price index, or PCE. PCE prices run cooler than the CPI, and lately, the gap between the two has been especially large. Thursday, the Commerce Department reported that overall consumer prices rose 0.3% in January from December, putting them up 2.4% from a year earlier. In contrast, the January CPI was up 3.1% from a year earlier.

US Consumer Price Index (CPI) 12-month Percentage Change

PCE prices excluding food and energy items—the “core” figure that policymakers and economists watch to better understand inflation’s underlying trend—rose 2.8% in January from a year earlier. That compares with a 3.9% increase in core CPI. While core PCE almost always runs cooler than the core CPI, the difference between the two has rarely been so wide. In the 60 years before the pandemic, their median gap was just 0.4 percentage points.

The biggest difference between the CPI and the PCE price indexes is their composition. The price weights for different items in the CPI depend on how much of their spending consumers say they devote to different items, based on annual surveys. The price weights in the PCE are based on what Commerce Department data suggest where the money gets spent. The gaps can be big. For example, the Commerce Department data show that Americans devote about twice as big a share of their spending to alcohol as the Labor Department figures. A late 1990s shift in the Fed’s focus toward the PCE index was driven by a view that the spending data was more accurate than the survey data. The transcript from the Fed’s December 1999 policy meeting shows then-Chairman Alan Greenspan stating his preference for the PCE—and railing against the CPI.1

US Personal-consumption Expenditures Price Index (PCE) 12-month Percentage Change

2. Eurozone Inflation Slows Less Than Forecast

Euro-zone inflation eased less than anticipated in February — supporting European Central Bank officials who don’t want to rush into lowering interest rates. Consumer prices rose 2.6% from a year ago in February, Eurostat said Friday. That’s above the 2.5% median estimate in a Bloomberg survey of economists. Core inflation, excluding volatile components such as food and energy, also moderated less than envisaged, to 3.1%. The slowdown was visible across the currency bloc as the surge in energy costs fades and the 20-nation economy stutters. Dips were announced in Germany, France, and Spain this week, while Italy said Friday that inflation was unchanged at 0.9%. While policymakers are optimistic that inflation is headed toward their 2% goal. They remain concerned that elevated increases in wages and labor costs risk stoking price pressures for longer. Indeed, despite economic weakness, the jobs market remains tight: A separate Eurostat release showed the unemployment rate was at a record-low 6.4% in January. President Christine Lagarde said Monday that “the current disinflationary process is expected to continue,” but that she and her colleagues need to see more evidence of a sustainable return to the target.2

3. Home Sales Rebounded in January

Sales of previously owned homes rose in January from the prior month, rebounding modestly after sales last year dropped to their worst level in nearly three decades. Mortgage rates have fallen about a percentage point since last fall, spurring some buyers to return to the market even though home prices remain near record highs. Home sales increased 3.1% in January from the prior month to a seasonally adjusted annual rate of 4 million, the highest level since August, the National Association of Realtors said Thursday. January existing-home sales, which make up most of the housing market, fell 1.7% from a year earlier.

A drop in rates since October has made home purchasing slightly more affordable for buyers and spurred more home-shopping activity. The average rate on a 30-year fixed mortgage has hovered between 6.6% and 6.8% so far this year, down from a recent high of 7.79% in October, according to Freddie Mac. But buyers are still facing an expensive market with little to choose from. The inventory of homes for sale is unusually low because homeowners are reluctant to sell and trade in their current low mortgage rates for higher ones. The low supply of homes on the market is pushing home prices higher. Home builders are benefiting from the shortage of existing homes on the market. A measure of U.S. home-builder confidence rose in February for the third straight month, the National Association of Home Builders said last week.1

4. BOJ Chief Ueda Stops Short of Declaring 2% Price Goal Met

Bank of Japan Governor Kazuo Ueda said it was too early to conclude that inflation was close to sustainably meeting the central bank’s 2% inflation target and stressed the need to scrutinize more data on the wage outlook. “I don’t think we are there yet,” Ueda told a news conference after attending the G20 finance leaders’ meeting in Sao Paulo when asked whether achievement of the price goal was already in sight. With inflation having exceeded 2% for well over a year, many market players expect the BOJ to end its negative interest rate policy by April.

Ueda’s remarks contrasted with those of BOJ board member Hajime Takata in Japan earlier on Thursday, who said the sustained achievement of 2% inflation was already in sight. The yen and Japanese bond yields rose after Takata’s hawkish remarks, which fueled speculation the BOJ could end negative rates in March rather than the widely held view that such a move would come in April. Big firms will settle negotiations on next year’s pay with unions on March 13, ahead of the BOJ policy meeting on March 18-19. Economists project wage hikes of about 3.9% on average, exceeding a 3.58% pay rise deal struck in 2023 that was the highest in three decades.3

5. Oil Prices Rise Ahead of OPEC Decision

Crude oil futures rose more than 1% on Friday as signs point to a tightening market ahead of an OPEC decision on production cuts. The West Texas Intermediate contract for April gained by $1.51, or 1.93%, to $79.77 a barrel. May Brent futures added $1.40, or 1.71%, to $83.31 a barrel. U.S. crude and the global benchmark booked a second consecutive monthly gain as front-month contracts trade at a premium to later months, which is typically a sign of a tightening oil market. OPEC is considering rolling over its production cuts through the second quarter and possibly the end of the year. The cartel and its allies are expected to decide on the cuts in the first week of March, sources told Reuters.

Brent crude futures could break out to $95 per barrel range in the second quarter as bulls have become more aggressive in buying at higher lows, Paul Ciana, a technical analyst with Bank of America, told clients in a note Thursday. A breakout through a resistance level of $84.80 to $85 per barrel for Brent would confirm a change to the upside, but the global benchmark will have to hold a support level of $79.50 to $80 a barrel in March, Ciana said. If Brent falls below that level, the benchmark could drop to the bottom of its range at $75 to $73 a barrel, he said. On the geopolitical front, cease-fire negotiations in the Israel-Hamas war are in jeopardy after scores of Palestinians were killed in Gaza City while waiting for humanitarian aid.4

Financial Markets

1. S&P 500 Posts 15th Record This Year as Tech Roars

The Nasdaq Composite rose to an all-time high Friday, surpassing its 2021 record, as investors bet that Mega cap technology stocks were the best way to play slowing inflation and a coming artificial intelligence boom. The tech-heavy Nasdaq advanced 1.14% to 16,274.94. A day earlier, the index closed at a record, its first since November 2021. The S&P 500 added 0.80% to 5,137.08 for its first close above the 5,100 threshold. The broad-market index also hit a new high during the session. The Dow Jones Industrial Average gained 90.99 points, or around 0.23%, to 39,087.38.

Chipmaking giant Nvidia, which has led the tech rally by surging more than 260% over the last 12 months, was up another 4% Friday. Meta also jumped more than 2% for the day. On a weekly basis, the Nasdaq added 1.74%, while the S&P 500, which also popped to a record close on Thursday, advanced 0.95%. Both indexes notched their seventh positive week over the last eight. The 30-stock Dow is the laggard, down 0.11%.4

2. NYCB Stock Sinks After Bank Finds ‘Material Weaknesses’ in Loan Reviews

New York Community Bancorp’s woes continue. Shares sank after the regional lender late Thursday replaced its chief executive, took a $2.4 billion charge, and said it had found problems with internal controls. The bank’s stock has already tumbled this year, partly on concerns about its holdings of commercial real estate. NYCB, which has more than $100 billion in assets, also has struggled since absorbing the assets of failed lender Signature Bank and an earlier merger with Flagstar Bank.

The lender said it had found “material weaknesses” in internal controls for reviewing loans, stemming “from ineffective oversight, risk assessment and monitoring activities.” NYCB logged a $2.4 billion goodwill impairment—an accounting charge for writing down the value of old acquisitions. Longtime CEO Thomas Cangemi stepped down. His replacement is Sandro DiNello, the former Flagstar Bank CEO who was named NYCB’s executive chairman early last month. The bank said its 2023 results could be delayed by up to 15 days as it works to fix the problems it has identified. NYCB stock stood around 20% lower in recent trading, at under $3.80. That put the shares on course for a multidecade low—they haven’t closed below $4 apiece since 1997, FactSet data shows. 1

3. Why Airlines Are Raising Baggage Fees

Airlines are raising their prices to check a bag — again. Just how much it will cost you, however, depends on when you pay for the service. United Airlines, American Airlines, and JetBlue Airways are among the carriers that have raised the price of check bags this year. Each of them charges customers more if they check their bags at the airport or close to their departure compared with paying to check a bag online in advance. Carriers are encouraging customers to pay to check their bags ahead of their flight, an approach the airlines argue will free up employees at check-in areas and get travelers to their gates faster.

Luggage fees are a big moneymaker for airlines. In the first nine months of 2023, U.S. airlines brought in more than $5.4 billion from baggage fees, up more than 25% from the same period of 2019, according to the Transportation Department’s latest data. Airlines have argued that higher costs such as labor and fuel, their biggest expenses, mean they had to raise bag fees. “While we don’t like increasing fees, it’s one step we are taking to get our company back to profitability and cover the increased costs of transporting bags,” JetBlue said in a statement about its latest increases. “By adjusting fees for added services that only certain customers use, we can keep base fares low and ensure customer favorites like seatback TVs and high-speed Wi-Fi remain free for everyone.”4

4. Apple’s iPhone Steeply Discounted in China on Weak Demand

Apple Inc.’s resellers in China are slashing the price of iPhone 15 models by as much as $180, signaling an unusually prolonged slump in demand. iPhone 15 Pro Max handsets are now selling at prices 1,300 yuan ($180) lower than their original on Alibaba Group Holding Ltd.’s Tmall. It’s a steeper drop than the roughly $120 discount the company offered on its smartphone lineup around the same time last year, and there are similar reductions on JD.com Inc.’s online platform. Apple’s store is selling the devices at original prices. The latest iPhone generation has not matched the usual popularity of Apple’s flagship series in China. Since its launch in September, owing to a combination of economic difficulty across the country as well as the surprising resurgence of Huawei Technologies Co.’s smartphone business, the iPhone 15 family has lagged sales of its predecessors.

The latest discounts emerged after the Lunar New Year holiday, following rare price reductions on Apple’s website in January. A company representative did not respond to a request for comment. Apple sales in China dropped 13% to $20.8 billion in the quarter ended December. That fell far short of the $23.5 billion predicted by analysts and was Apple’s weakest performance for that period in the Asian nation in years.2

5. Dell Soars to Record Fueled by Excitement for AI Prospects

Dell Technologies Inc. surged as much as 38% to a record high after reporting better-than-expected sales and profit, fueled by demand for information technology equipment to handle artificial intelligence work. Known for its PC business, Dell has attracted investor attention over the last year due to a spike in interest in its high-powered servers needed to run AI workloads. The company’s infrastructure unit, which includes servers, reported revenue of $9.33 billion in the fiscal fourth quarter, topping estimates. A sequential increase in sales from the previous period was “driven primarily by AI-optimized servers,” Dell said Thursday, though the unit’s total revenue declined 6% from the same quarter a year earlier. The shares pared some of their initial gains but were still up 25% to $118.50 Friday morning in New York, the highest price ever. The stock has nearly tripled over the last 12 months amid investor excitement about the role of servers in an AI-driven purchasing cycle.

“We’ve just started to touch the AI opportunities ahead of us, and we believe Dell is uniquely positioned with our broad portfolio to help customers build GenAI solutions that meet performance, cost, and security requirements,” Chief Operating Officer Jeff Clarke said in a statement, referring to generative AI. The backlog for AI servers was $2.9 billion at the end of the period on Feb. 2, he said. Dell shipped $800 million in AI-optimized servers in the quarter, Clarke said in remarks prepared for a conference call on the results. Like many in the industry, however, the business is being held back by the availability of advanced computer chips, Clarke added. Demand continues to outpace supply, “though we are seeing H100 lead times improving,” referring to market-leading Nvidia Corp.’s chip. 2

Sources:

(1) www.wsj.com

(2) www.bloomberg.com

(3) www.reuters.com

(4) www.cnbc.com

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual security. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. Economic forecasts set forth may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond and bond mutual fund values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Investing in stock includes numerous specific risks, including the fluctuation of dividends, loss of principal, and potential illiquidity of the investment in a falling market.

Investing in foreign and emerging market securities involves special additional risks. These risks include but are not limited to currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

Investment advice offered through Private Advisor Group, a registered investment advisor and separate entity from The Legacy Foundation.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

The Legacy Foundation and LPL Financial do not offer tax advice.

Recent Comments